Easy Ways To Get Out Of Debt Fast

Being burdened with debt can feel overwhelming and suffocating, affecting every aspect of your financial life.

The good news is that with the right strategies and a commitment to change, you can break free from the chains of debt and regain control over your finances. In this comprehensive guide, we will explore easy ways to get out of debt fast, providing you with practical tips, budgeting strategies, and insights into saving money and increasing your income.

By following these steps, you’ll be well on your way to achieving financial freedom and a debt-free future.

Assess Your Current Financial Situation

Before embarking on your journey to become debt-free, it’s crucial to assess your current financial situation. This involves gaining a clear understanding of the amount of debt you owe and evaluating your income and expenses.

A. Calculate Your Total Debt

The first step in taking control of your debt is to determine the exact amount you owe. Gather all your financial statements, including credit card bills, student loan documents, mortgage statements, and any other outstanding debts. Create a comprehensive list of your debts, noting the outstanding balances, interest rates, and minimum monthly payments for each.

Having a complete picture of your debt will allow you to prioritize and develop an effective plan for repayment. It’s essential to face the numbers head-on, even if they may seem daunting at first. Remember, this is the starting point towards financial freedom.

B. Understand Your Income and Expenses

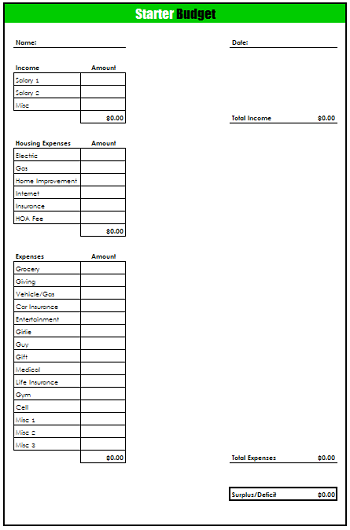

To successfully eliminate debt, you need to gain a clear understanding of your income and expenses. Start by calculating your total monthly income, considering all sources such as your salary, freelance work, or rental income.

Next, list all your monthly expenses, including fixed expenses (rent or mortgage payments, utilities, insurance) and variable expenses (groceries, transportation, entertainment). Be thorough and include even the smallest expenses, as they can add up over time.

Once you have both your income and expenses calculated, subtract your total expenses from your income. The resulting amount will indicate whether you have a surplus or a deficit each month. Understanding your income and expenses will help you identify areas where you can cut back and save money to allocate towards debt repayment.

C. Establish a Realistic Budget

Now that you have a clear picture of your income and expenses, it’s time to create a realistic budget. A budget acts as a roadmap for managing your finances and serves as a tool for tracking your progress.

Start by categorizing your expenses into essential and discretionary spending. Essential expenses are necessary for your basic needs, such as housing, food, and transportation. Discretionary expenses, on the other hand, are non-essential and can be reduced or eliminated to free up more money for debt repayment.

Review your discretionary spending and identify areas where you can make cuts. For example, consider packing your lunch instead of eating out, reducing your cable TV package, or finding more affordable alternatives for entertainment. Every dollar saved can make a significant impact on your debt reduction journey.

Remember, creating a budget isn’t about deprivation; it’s about making intentional choices and prioritizing your financial goals. Be realistic and flexible with your budget, allowing room for unexpected expenses and occasional treats.

D. Set Up an Emergency Fund

As you start paying off your debts, it’s crucial to simultaneously build an emergency fund. An emergency fund acts as a safety net, preventing you from falling back into debt when unexpected expenses arise.

Begin by setting a small, achievable savings goal, such as $500 or $1,000, and gradually work your way up to three to six months’ worth of living expenses. Look for ways to save money, such as cutting back on non-essential expenses or redirecting windfalls, like tax refunds or

unexpected bonuses, towards your emergency fund.

Having an emergency fund provides you with financial security and peace of mind, knowing that you have a buffer to rely on in case of unforeseen circumstances like medical emergencies, car repairs, or job loss. Instead of resorting to credit cards or loans during tough times, you can tap into your emergency fund, avoiding further debt accumulation.

Consider opening a separate savings account specifically designated for your emergency fund. Automate regular contributions to this account to make saving a habit. Even small amounts added consistently can accumulate over time, providing you with a solid financial cushion.

Remember, building an emergency fund may require some sacrifices and discipline in the short term, but the long-term benefits far outweigh the temporary inconvenience. By having this financial safety net in place, you’ll be better equipped to stay on track with your debt repayment goals.

Budgeting Strategies for Debt Repayment

Now that you have a clear understanding of your financial situation and have established an emergency fund, it’s time to delve into effective budgeting strategies that will accelerate your debt repayment journey.

A. Prioritize Your Debts

Not all debts are created equal, and it’s important to prioritize which debts to tackle first. There are two popular approaches to debt prioritization: the debt snowball method and the debt avalanche method.

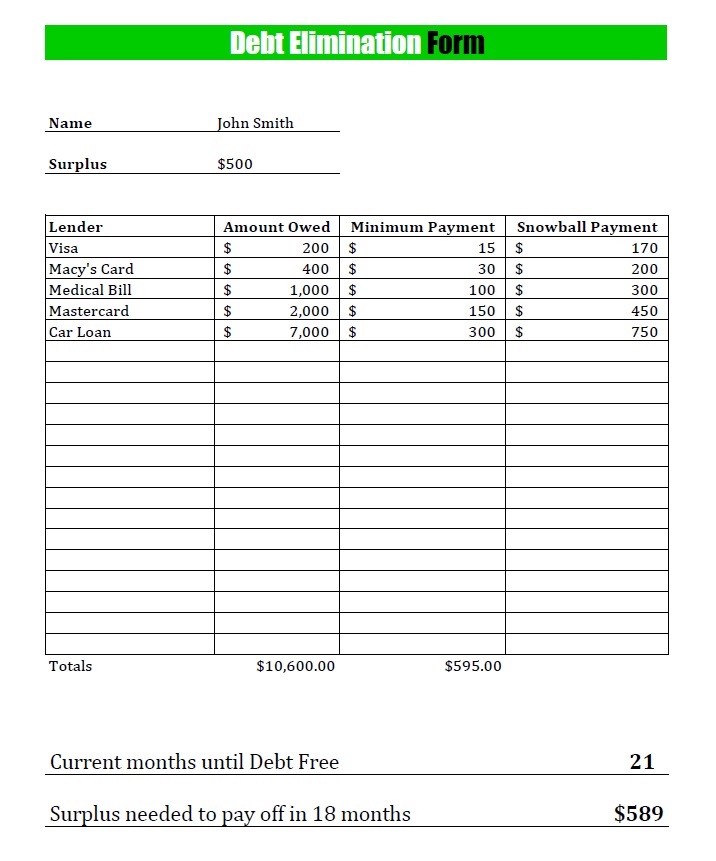

The debt snowball method involves listing your debts from smallest to largest balance, regardless of the interest rates. You focus on paying off the smallest debt first while making minimum payments on other debts. Once the smallest debt is paid off, you roll the amount you were paying towards it into the next smallest debt. This approach provides a psychological boost as you experience quick wins, motivating you to continue the momentum.

The debt avalanche method, on the other hand, focuses on prioritizing debts based on their interest rates. Arrange your debts from the highest to the lowest interest rate, regardless of the balance. Make minimum payments on all debts while directing any extra funds towards the debt with the highest interest rate. Once that debt is paid off, move on to the next highest interest rate debt. This method helps minimize the overall interest paid over time.

Choose the method that aligns best with your financial preferences and personality. While the debt snowball method may provide quick victories, the debt avalanche method can save you more money in interest payments. Assess your priorities and decide which approach will keep you motivated and committed to your debt repayment goals.

B. Create a Realistic Budget

Now that you have a debt repayment strategy in place, it’s time to create a realistic budget that supports your goals. Budgeting is about making conscious choices and allocating your money in a way that aligns with your priorities.

Start by revisiting your list of expenses and identifying areas where you can cut back. Look for recurring monthly expenses that can be reduced or eliminated, such as subscription services, dining out, or entertainment expenses. Be mindful of your spending habits and differentiate between needs and wants.

Consider implementing cost-saving measures in your daily life. For example, pack your lunch for work, brew your coffee at home, or shop for groceries with a list to avoid impulse purchases. Small changes in your habits can lead to significant savings over time.

Negotiating bills can also be an effective way to save money. Contact your service providers and inquire about potential discounts or promotional offers. You might be surprised at the savings that can be achieved by simply asking.

Additionally, explore cost-saving options for necessities like insurance or utility providers. Shop around for better rates, compare quotes, and consider switching to more affordable options without compromising on quality.

Remember, budgeting is an ongoing process that requires regular review and adjustments. As your financial situation evolves and debts are paid off, revisit your budget and reallocate funds towards debt repayment or savings.

C. Set Up an Automated Debt Repayment Plan

To ensure consistent progress in paying off your debts, consider setting up an automated debt repayment plan. Automation takes the guesswork out of making payments and ensures that you never miss a due date.

Start by contacting your creditors or financial institutions to set up automatic payments for your debts. Most lenders offer online payment options that allow you to schedule recurring payments directly from your bank account. Determine the amount you can afford to allocate towards debt repayment each month and set up the automatic payments accordingly.

Automating your debt payments not only saves you time and effort but also eliminates the risk of late fees or missed payments. It helps you stay disciplined and committed to your debt-free journey.

Debt Repayment Strategies

Now that you have a solid budget in place, it’s time to explore different debt repayment strategies that can expedite your path to financial freedom.

A. Debt Snowball Method

If you opted for the debt snowball method during the prioritization phase, it’s time to put it into action. Start by making minimum payments on all your debts except the smallest one. Allocate any additional funds available in your budget towards this smallest debt until it is paid off completely.

Once the smallest debt is eliminated, celebrate your achievement and redirect the amount you were paying towards it to the next smallest debt. Repeat this process, rolling over the payments from each paid-off debt to the next, until you’ve cleared all your debts.

The debt snowball method works wonders by providing psychological motivation. As you eliminate smaller debts first, you gain a sense of accomplishment and momentum, empowering you to tackle larger debts with increased confidence.

B. Debt Avalanche Method

If you chose the debt avalanche method, it’s time to put it into action. Begin by making minimum payments on all your debts except the one with the highest interest rate. Allocate any extra funds available in your budget towards this high-interest debt.

By focusing on the debt with the highest interest rate, you reduce the overall interest you’ll pay in the long run. Once this debt is paid off, move on to the next debt with the next highest interest rate and repeat the process.

The debt avalanche method helps you save money on interest payments over time and allows you to become debt-free faster, even though it may not provide the immediate psychological wins of the debt snowball method.

C. Debt Consolidation

If you have multiple high-interest debts, debt consolidation might be a viable option. Debt consolidation involves combining your debts into a single loan with a lower interest rate.

By consolidating your debts, you simplify your repayment process and potentially save money on interest. You can achieve debt consolidation through various methods, such as taking out a personal loan, transferring balances to a low-interest credit card, or using a debt consolidation service.

Before pursuing debt consolidation, carefully consider the terms and conditions, including any fees involved. Evaluate whether the new loan or credit card offer lower interest rates and affordable monthly payments. Debt consolidation can be beneficial if it helps you simplify your repayment strategy and lower your overall interest payments.

Remember, debt consolidation is not a magic solution, and it’s important to address the underlying causes of your debt to avoid falling into the same cycle in the future.

Increasing Income

While budgeting and debt repayment are crucial, increasing your income can significantly expedite your journey to becoming debt-free. Here are some effective ways to boost your income:

A. Explore Side Hustle Opportunities

Taking on a side hustle can be an excellent way to earn additional income that can be directed towards debt repayment. Look for opportunities that align with your skills, interests, and availability. Some popular side hustles include freelance writing, graphic design, tutoring, pet sitting, or driving for rideshare services.

Consider your strengths and passions when choosing a side hustle. This not only allows you to earn extra

income but also provides a fulfilling and enjoyable experience. Explore online platforms and job boards dedicated to connecting freelancers with clients in need of specific services.

When selecting a side hustle, be mindful of the time commitment required and ensure it doesn’t interfere with your primary source of income or your overall well-being. Finding the right balance is key to avoiding burnout and maintaining a sustainable side hustle.

B. Negotiate a Raise or Promotion

Increasing your income doesn’t always mean taking on additional work. It’s important to recognize your value in your current job and explore opportunities for a raise or promotion.

Prepare a case for yourself by documenting your accomplishments, highlighting your contributions to the company, and illustrating how you have exceeded expectations. Schedule a meeting with your supervisor or manager to discuss your performance and potential for advancement.

Approach the conversation with confidence and professionalism. Clearly articulate your goals and why you believe you deserve a raise or promotion. Be open to feedback and suggestions for improvement. Even if you don’t secure an immediate raise or promotion, the conversation sets the stage for future opportunities and demonstrates your commitment to growth.

C. Explore Passive Income Sources

Passive income refers to money earned with minimal effort on an ongoing basis. While it may require upfront investment or effort to set up, passive income can provide a steady stream of revenue that can be used to accelerate your debt repayment.

Consider various passive income sources, such as investing in stocks or real estate, renting out property or a room through platforms like Airbnb, creating and selling digital products or online courses, or participating in affiliate marketing.

Research and educate yourself on the different passive income options available, taking into account your risk tolerance, skills, and interests. While passive income requires initial effort and investment, it can provide long-term financial benefits and contribute significantly to your debt-free journey.

Stay Motivated and Committed

Embarking on a journey to become debt-free requires perseverance, discipline, and a strong sense of motivation. Here are some strategies to help you stay on track:

A. Celebrate Milestones and Progress

As you make progress in paying off your debts, it’s important to celebrate each milestone along the way. Whether it’s paying off a particular debt, reaching a savings goal, or achieving a certain percentage of overall debt reduction, take the time to acknowledge your accomplishments.

Celebrating milestones reinforces your commitment to your financial goals and provides a sense of achievement. It serves as a reminder of the progress you’ve made and motivates you to continue moving forward.

However, celebrations need not be extravagant or costly. Find meaningful and affordable ways to reward yourself, such as treating yourself to a favorite meal, indulging in a self-care activity, or engaging in a hobby you enjoy. The key is to acknowledge your efforts and maintain a positive mindset throughout your debt-free journey.

B. Seek Support and Accountability

Surrounding yourself with a supportive network is crucial when working towards financial goals. Share your debt repayment journey with trusted friends or family members who can provide encouragement and understanding. Consider joining online communities or forums where like-minded individuals share their experiences and provide support.

Finding an accountability partner can also be highly effective. Choose someone who shares similar financial goals or is also working towards becoming debt-free. Regularly check in with each other, share progress, and hold each other accountable for staying on track.

Being part of a supportive community or having an accountability partner not only provides emotional support but also serves as a reminder of your commitment to achieving financial freedom.

Conclusion

In conclusion, the journey to getting out of debt fast requires a combination of smart financial decisions, disciplined budgeting, and proactive measures to increase your income. By assessing your current financial situation, creating a realistic budget, prioritizing your debts, and exploring debt repayment strategies like the debt snowball or debt avalanche methods, you can make significant progress towards becoming debt-free.

In addition, don’t underestimate the power of increasing your income through side hustles, negotiating for a raise or promotion, or exploring passive income sources. These avenues provide additional financial resources that can expedite your debt repayment journey.

Throughout this process, it’s important to stay motivated, celebrate milestones, and seek support from your network or online communities. Remember that becoming debt-free is a journey that requires perseverance and commitment, but the rewards are well worth the effort.

As you implement the tips and strategies outlined in this article, always keep your long-term financial goals in mind. Imagine the freedom and peace of mind that come with being debt-free, allowing you to focus on building wealth, pursuing your passions, and enjoying a more secure financial future.

Take the first step today and start implementing these easy ways to get out of debt fast. You have the power to transform your financial life and create a brighter future free from the burdens of debt.

- 8 Strategic Moves for Business Growth: Your Roadmap to Success - November 20, 2023

- Easy Ways To Get Out Of Debt Fast - May 15, 2023

- Strategies for Successful Business Scaling - May 14, 2023