“Why Am I Always Broke?”

Key Takeaways:

| Aspect | Key Points |

|---|---|

| Root Causes | Identifying common reasons behind financial struggles |

| Behavioral Patterns | Understanding the impact of spending habits |

| Solutions | Strategies to improve financial health, including internal links to Increase Monthly Income and Online Job Opportunities |

Feeling perpetually broke can be both frustrating and disheartening, leaving many to wonder, “Why am I always broke?” This article delves into the various factors that might be draining your wallet, and offers practical solutions to turn your financial tide.

The Culprits Behind Constant Money Woes

1. Living Beyond Means: It’s not uncommon to spend more than what we earn. This lifestyle, fueled by credit cards and loans, leads to a vicious cycle of debt.

2. Lack of Financial Planning: Without a budget or financial plan, managing money becomes a daunting task. Unplanned expenses can quickly derail financial stability.

3. Minimal Savings: Neglecting to save for emergencies or future goals means you’re always one unexpected bill away from financial turmoil.

4. Lifestyle Inflation: As income increases, so does spending. This phenomenon, known as lifestyle inflation, can prevent building substantial savings.

5. High-Interest Debt: Credit card debt, payday loans, and other high-interest debts can consume a significant portion of your income.

Behavioral Patterns: How Habits Impact Finances

Understanding the psychological aspects of spending is crucial. Impulsive buying, retail therapy, and the desire to keep up with societal trends can lead to chronic financial stress. Recognizing these patterns is the first step toward change.

Solutions to Escape the ‘Broke’ Cycle

- Budgeting: Start by creating a realistic budget. Track your income and expenses to identify areas where you can cut back.

- Debt Management: Focus on paying off high-interest debts first. Consider strategies like debt consolidation or negotiating with creditors.

- Income Boosting: Look for ways to increase your income. Explore opportunities in Online Job Opportunities, or consider side hustles.

- Savings Plan: Begin with small, achievable savings goals. Even a modest emergency fund can provide financial security.

- Lifestyle Adjustments: Reevaluate your lifestyle choices. Opt for more affordable alternatives that align with your budget.

Create a Budget To Help Escape Being Always Broke

66% of Americans don’t have a budget.

Even a fundamental one goes a long way in helping assist your buying choices.

How To Fix It:

If you have no idea where to begin, begin with the 50/20/30 guideline.

50% of your take-home goes to housing, food, transport costs, and utility expenses.

20% is sent into savings/paying off debt.

30% is for you.

It’s important to keep in mind that this is based upon your take-home pay. Don’t make budgeting choices on your gross pay (gross being the amount you make BEFORE taxes takes a chunk out of it), or you’re most likely to be sorely dissatisfied when taxes begin coming out, and you question why you still have a hard time to make ends meet.

You Ignore Your Money Problems

Cash issues can cause enormous stress and anxiety, strained relationships, and depression. Negative decisions can get you to where you are, but you significantly worsen them by not getting the help you require in taking on the issue head-on.

You lack the money you need right now? Continue ignoring your money problems and see where you are in a year – it’s a good bet thing will have only gotten worse thanks to your continued refusal to face these problems head-on.

How To Fix It:

Don’t Ignore problems hoping they will go away on their own and don’t be too worried to ask others for help. Put in the time to enlighten yourself. There is absolutely nothing even more eliminating than knowing that you took that first positive step in the best direction.

You Go Out Too Much

The 50/20/30 policy is specifically useful to individuals in this group because those proportions begin to look like 50/0/60 where you’re always maxing out your spending on basics, conserving absolutely nothing, pushing yourself right into financial debt.

Whether it’s eating out, shopping, or gambling, it doesn’t matter. We all have our vices, and it takes discipline/lifestyle adjustments to deal with the root of our overspending problems.

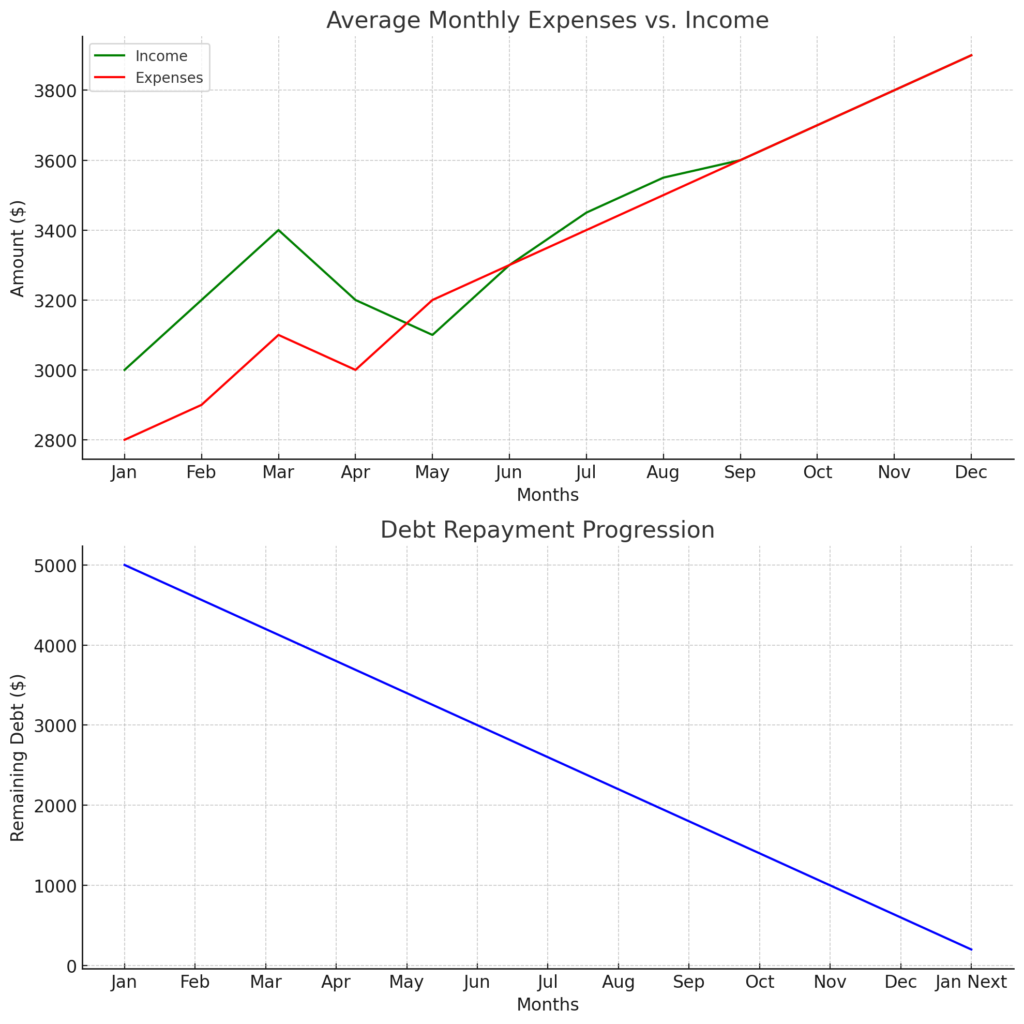

- Average Monthly Expenses vs. Income: This graph shows the comparison between monthly income and expenses throughout the year. It illustrates the importance of keeping expenses below income to avoid financial strain.

- Debt Repayment Progression: This chart displays the progression of debt repayment over time, assuming consistent monthly payments. It demonstrates how strategic debt management can effectively reduce liabilities.

These visualizations offer a clear perspective on the importance of budgeting and debt management in improving one’s financial situation.

Create a monthly budget and stick to it for at least three months. During this time, do no unnecessary spending and see what a difference it makes on your overall cash flow and savings situation.

Consider Starting a Side Hustle

If you’re having a hard time making ends meet and you have no means to up your pay at your day job/no promotion on the horizon, then you need a side hustle.

Not every little thing available will be suitable for you and your needs, but I assure you that you’ll find something that is perfect for you if you look.

Side hustles enabled me to supplement my take-home income by thousands each month to the point that I was able to quit my day job and spend my time the way I want to. Side hustles are my number one recommended the FIRST STEP to financial freedom.

They are the first step in that they won’t make you rich overnight, but they will open the doors to your money-making potential and make you realize that you can do things on your own without begging a boss to give you a raise every six months just to keep up with your house payments.

How to Fix It:

If you’re thinking, “I do not have time for all this – I need cash fast!” then you, my friend, should get on your side hustle grind. Try this checklist of ways to make extra money and take a look a this for tips on how to make money online. If you’re specifically interested in creating an income online, check out this online startup resource system.

Say Goodbye to Being Always Broke

Kanye West once wrote;

“Having money’s not everything, not having it is.”

When you’re broke being broke is, unfortunately, everything. When you’re struggling to pay rent, running out of food, and have no financial safety net of any kind it can be hard to think about anything else. Being broke can become a mental prison while making you feel like you’re under house arrest.

Once you have money, you have the privilege to not have to worry about money anymore, you’re not worried about being evicted or where your next meal will come from. You now have a kind of freedom that is both mental and lifestyle based since with money you can go out and do things. It’s a shame that this is the way things are but there no use pretending things are different.

Expanding Your Financial Horizons

Expanding your income is a viable strategy to break free from the cycle of being constantly broke. Let’s explore some effective ways to boost your earnings.

Enhancing Skills for Better Opportunities

Investing in your skills can open doors to higher-paying job opportunities. Whether it’s through formal education or online courses, enhancing your skill set is a surefire way to increase your market value.

Side Hustles: Turning Passions into Profits

Side hustles can be more than just a way to earn extra cash; they can also be a source of personal fulfillment. From freelance writing to online tutoring, the possibilities are endless. Dive deeper into this topic with our guide on Online Job Opportunities.

Smart Investments: Making Your Money Work for You

Investing can be a powerful tool for wealth generation. Whether it’s stocks, real estate, or mutual funds, informed investing can yield substantial returns over time.

Networking: The Key to Hidden Opportunities

Often, the best opportunities come through connections. Networking can lead to higher-paying jobs, lucrative side projects, or valuable business partnerships.

Key Takeaways and Conclusion

| Aspect | Summary |

|---|---|

| Budgeting | Essential for tracking and managing finances. |

| Income Sources | Exploring diverse income streams, including online opportunities. |

| Investments | Leveraging investments for long-term financial growth. |

| Networking | Utilizing connections for better opportunities. |

In conclusion, understanding the root causes of financial strain and actively working to address them is crucial. From budgeting to exploring new income avenues like those offered in our 6 Proven Strategies to Increase Monthly Income, there are numerous ways to improve your financial health.

If you need some fast cash check out this blog post on quick ways to make a few extra bucks, please note it’s not ways to get rich quick that’s just some ways to make some extra money each day to help out a little bit. If you’re looking for ways to build a business you could consider looking into starting a blog, it may sound ‘old hat’ but it works for us here at Great Plan Ray and can likely work for you, learn more about that here.

Sign up for our email list for more financial and business information below:

- How to Save Money on Marketing (Without Scaling Back) - October 15, 2022

- Become Your Own Marketing Department With These Essential Tips - October 5, 2022

- The 100 Best Money Quotes of All Time - August 16, 2022

There is perceptibly a bunch to identify about this. I assume you made certain good points in features also.

I consider something genuinely interesting about your weblog so I bookmarked .